If you’re looking for a comprehensive Fairplay App review, you’ve come to the right place. In this article, we will discuss everything you need to know about the Fairplay betting app. We’ll start by discussing some basic information about the app, such as what devices it is available on and which betting options are available. Then we’ll show you how to download the app on both Android and iOS devices. After that, we’ll go over some of the upsides of using Fairplay and conclude with a few final thoughts. So without further ado, let’s get started!

Information About Fairplay App

Fairplay is a mobile betting app that allows you to place bets on a variety of sporting events. The app is available for both Android and iOS devices. You can use the Fairplay app to bet on any sport that you like, including football, basketball, baseball, hockey, golf, and more.

The Fairplay app is very easy to use. The design is clean and user-friendly, and the navigation is straightforward. You can easily find the betting markets that you’re looking for and place your bets with just a few taps.

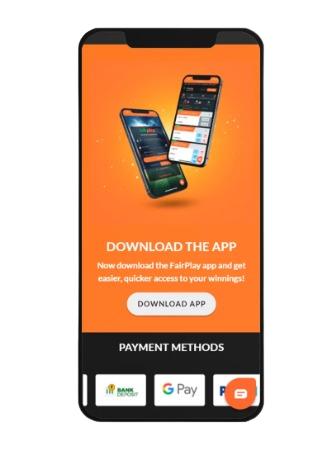

One of the best things about Fairplay is that it offers a wide range of payment methods. You can deposit and withdraw money using credit cards, debit cards, e-wallets, and more. Fairplay also offers a good selection of bonuses and promotions, which we’ll discuss in more detail later on.

Fairplay App | Betting in a mobile client

If you have installed the Fairplay application, then you expect to place bets. To place a bet , you must have an account with Fairplay. If you do not have an account, then you can create one by following the registration procedure. The registration process is pretty standard and does not require any special documents from you.

After creating an account, go to the “Deposit” page and choose one of the many methods available to replenish your balance. You may fund your account with a credit or debit card, as well as one of the many e-wallets accessible.

Now that your account is funded, it’s time to place a bet! To do this, go to the “Sports” page and select the event you want to bet on. Once you’ve selected the event, you’ll see a list of available betting markets. Select the market that you want to bet on and enter your stake in the bet slip. Then just click “Place Bet” and your bet will be placed!

Betting Options in the Fairplay App

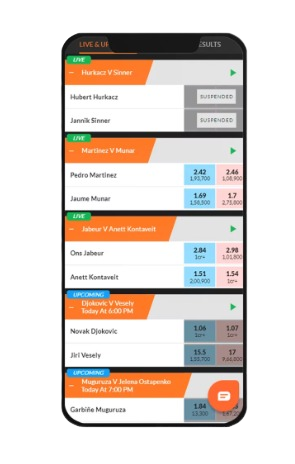

As we mentioned earlier, Fairplay offers a wide range of betting markets. In addition to traditional betting markets such as moneyline and point spread bets, Fairplay also offers live betting.

Live betting is a great way to get in on the action while the game is ongoing. With live betting, you can bet on things such as who will score the next goal, what the next play will be, and more. Fairplay offers a wide range of live betting markets, so you’re sure to find something that interests you.

In addition to sports betting, Fairplay also offers a casino. The Fairplay casino features a wide selection of slots, table games, and more. There is something for everyone in the Fairplay casino, so be sure to check it out!

Finally, we should mention that Fairplay also offers a live dealer casino. In the live dealer casino, you can play classic casino games such as blackjack, roulette, and baccarat with a real dealer. The live dealer casino is a great way to add some excitement to your Fairplay experience.

How To Download FairPlay Mobile App

Now we’ll show you how to download the Fairplay app on both Android and iOS devices.

How to Download Android App

To download the Fairplay app on Android, you should follow these simple steps:

– Go to the Fairplay website and click on the “Download for Android” button.

– Once the file has downloaded, open it and install the app.

– Open the app and log in with your Fairplay account.

– That’s it! You’re now ready to start betting on your favorite sports.

How to Download IOS APP

Follow these easy procedures to get the Fairplay app for iOS::

– Go to the App Store and search for “Fairplay.”

– Once you’ve found the app, click “Get” to download it.

– Once the app has been downloaded, open it and log in using your Fairplay account.

– That’s all there is to it! You’re now prepared to start betting on your favorite sports.

Some necessary system requirements for downloading

To download the Fairplay app, your device must meet the following system requirements:

Android:

– Your device must be running Android 6+ version

– Your device must have at least 50 MB of free storage space.

iOS:

– Your device must be running iOS 8.0 version

– Your device must have at least 60 MB of free storage space.

If your device does not meet these requirements, you will not be able to download the Fairplay app.

The difference between the app and the mobile version of Fairplay

The main difference between the Fairplay app and the mobile version of Fairplay is that the app is designed specifically for mobile devices. The mobile version of Fairplay is just the regular website that has been optimized for mobile devices.

While both the app and the mobile version of Fairplay offer a great betting experience, we recommend using the app if you can. The app is faster and more user-friendly, so you’ll be able to place your bets more quickly and easily.

If you can’t use the app for some reason, the mobile version of Fairplay is a great alternative. You’ll still be able to bet on all of your favorite sports and events, so you won’t be missing out on anything.

A detailed guide on the use of the Fairplay ap

First step: open the Fairplay app and log in with your account.

Second step: select the event you want to bet on from the list of events.

Third step: choose the type of bet you want to make.

Fourth step: enter the amount of money you want to bet and click “Place Bet.”

Fifth step: confirm your bet and wait for the result.

Fairplay Customer Support

If you need help with anything, Fairplay offers excellent customer support. You can contact customer support through the app or the website. Customer support is available 24/

seven, so you’ll always be able to get help when you need it.

In addition to email and live chat support, Fairplay also has a detailed FAQ section on the website. The FAQ section covers a wide range of topics, so you’re likely to find the answer to your question there.

If you can’t find the answer to your question in the FAQ section, customer support will be more than happy to help you out.

Upsides of Using Fairplay App

Here the most important upsides of using Fairplay app:

– If you’re a big sports or event fan, you can bet on them from practically anywhere.

– The software is quick and easy to use, so you may quickly and simply wager your money.

– You will always find a friendly face to answers your questions and assist you if needed.

– You’ll be able to bet on a variety of markets.

– The odds are competitive, and there are many opportunities to obtain good value wagers.

– You can send and receive money quickly and simply.

Final words

In conclusion, the Fairplay app is a great way to bet on your favorite sports and events. The app is easy to use and offers a great betting experience. A good selection of markets and competitive odds make Fairplay a great choice for bettors. Excellent customer support is also available if you need assistance. To all other, the Fairplay is very safe and secure to use, because all transactions and data are encrypted. So don’t hesitate and start betting on your favorite sports today!